Stamp Duty is a tax levied on legal instruments such as cheques, receipts, military commissions, marriage licenses, property and land transactions. It is a payable in different rates depending on the nature of the instrument. KRA partners with various entities and collects revenue on their behalf which is known as agency revenue, with Stamp duty being one of them.

For transactional instruments prepared locally the tax should be paid within 30 days. For documents executed abroad and sent for registration locally, Stamp Duty must be paid within 30 days of receiving the documents. When Stamp Duty is not paid within that time frame, this results in the invalidity of the relevant transaction and any agreement signed between the parties becomes void, and is inadmissible in a Court of Law as evidence. Failure to pay the revenue also leads to a fine that is assessed at five percent (5%) of the principal assessed Stamp Duty for every quarter from the date of the Instrument.

Previously, when dealing with a transaction that would attract Capital Gains Tax (CGT), for example purchasing a property or transfer of shares, then the payment of Stamp Duty would only be processed if the CGT has been paid. The process was simplified via the iTax system and the two payments are no longer twinned. One can now successfully process Stamp Duty payment without the mandatory acknowledgement number that was required from the CGT payment on the iTax system. The change was introduced to improve ease of doing business by creating efficiency in the process. Thus, the unnecessary delay that came with the waiting for one party to make a certain payment first, is now a thing of the past.

The government has further simplified the process by introducing Ardhipay through the Ardhisasa platform. In line with the changing times and innovation our country has been at the forefront of embracing technology. The government has embarked on a move to digitise all government services, the President of the Government of Kenya issued a directive to consolidate all payments being made to the government in early August 2023. The payments would be via a single payment platform under the designated Paybill Number 222222. This was followed with the closure of all existing non-designated Paybill Numbers by 10th August 2023.

The Kenya Revenue Authority made it possible for the public to make payments at the state department for Lands and Physical Planning. The Ministry of Lands, Public Works, Housing and Urban Development, through the State Department of Lands and Physical Planning, on 17th of November 2023 issued a public notice effecting the same. It directed that stamp duty payments shall be made on the Ardhisasa portal (https://ardhisasa.lands.go.ke/) through the Ardhipay service. The system provides one with various options of payment i.e. M-PESA Paybill 222222 or RTGS payments through different banks.

Previously, for one to pay stamp duty, you had to log into the iTax portal of the individual required to pay for the stamp duty; key in the necessary details of the property in question and the assessed amount. By a government valuer. This would generate a Payment Registration Number (PRN) which would be used when making the stamp duty payment. With Ardhipay, the process has been simplified and, dare say, is “foolproof”.

There are two specified options on the ardhipay in regards to Stamp Duty payment:

- Stamp Duty Self-Assessment Option – for defined transactions such as transfers, charge, discharge of charge, Power of Attornery (POA), easements, long-term leases inter alia.

- Ardhipay Option: This is for undefined instruments such as share transfers, sale agreements, share purchase agreements, policies etc

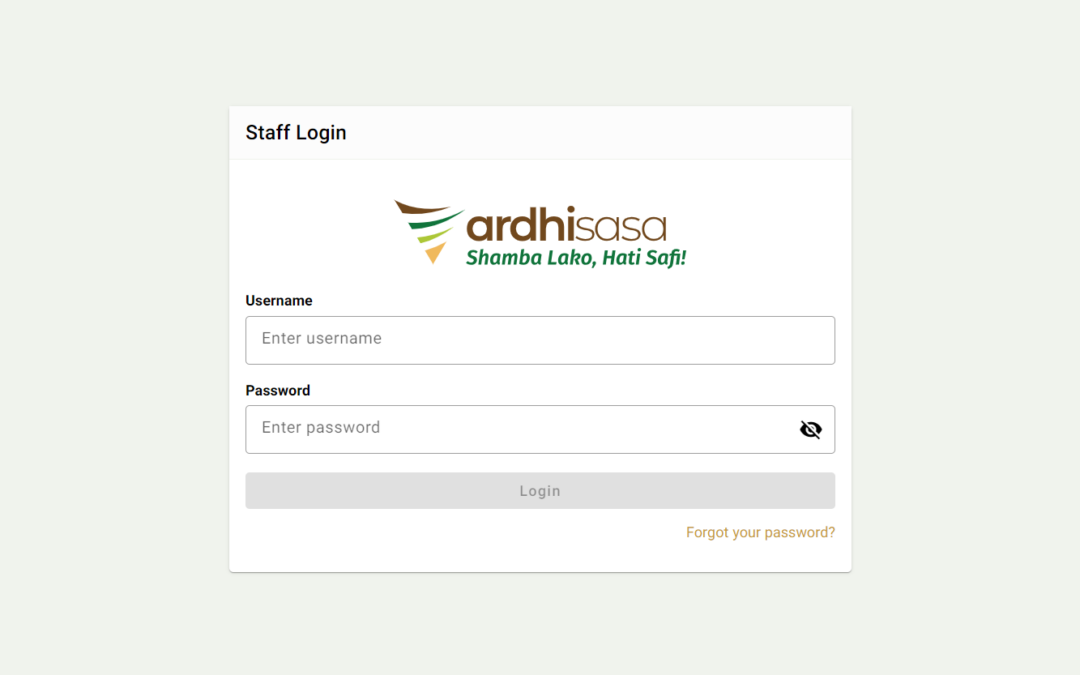

The stamp duty self-assessment option is straightforward but should be handled by an advocate. An Advocate holds a different type of Ardhisasa account as compared to the general public and they are required to upload their current Parcticing Certificate to hold that type of account. For the Ardhipay option, the procedure is as follows:

- Log into the Ardhisasa portal;

- Select Ardhipay then select on Ardhipay Service tab;

- Next, choose the “New Application” tab;

- Enter the county details and then select the relevant registry where the document will be franked;

- On the Department tab Select “Department of Land Registration”;

- Choose “Others” on the Type of Application tab;

- Enter the instrument information i.e. sale agreement, share transfer, SPA, on the “Payment Item” tab;

- Enter the parcel details i.e. Title Number”, or (enter N/A- for share transfers and other instruments not parcel/ land related);

- Enter the number of documents on the Quantity tab. Unfortunately, the system does not allow indicating the other documents as counterparts. Should you input 2 or more, the amount invoiced will doubled or multiplied by the number of documents indicated. This needs to be addressed;

- On the “rates per quantity” field, indicate the assessed amount; and

- An invoice will be generated and you may proceed to pay using the payment options provided that is either MPESA, RTGS

MPESA OPTIONS

Option 1

- Click on the featured link on the invoice to receive an MPESA menu

- Enter the MPESA pin and then click on OK

- You will receive a confirmation SMS from M-PESA

Option 2

- Go to M-PESA menu on your phone

- Select Paybill option

- Enter Business Number 222222

- Enter the Account Number featured in the instructions

- Enter the amount to be paid

- Enter your M-PESA pin and Send

This publication does not represent legal advice by its author.

For legal advice contact our partner: Lynn W. Ngugi